The Peer to Peer Electronic Money System

Why Agau?

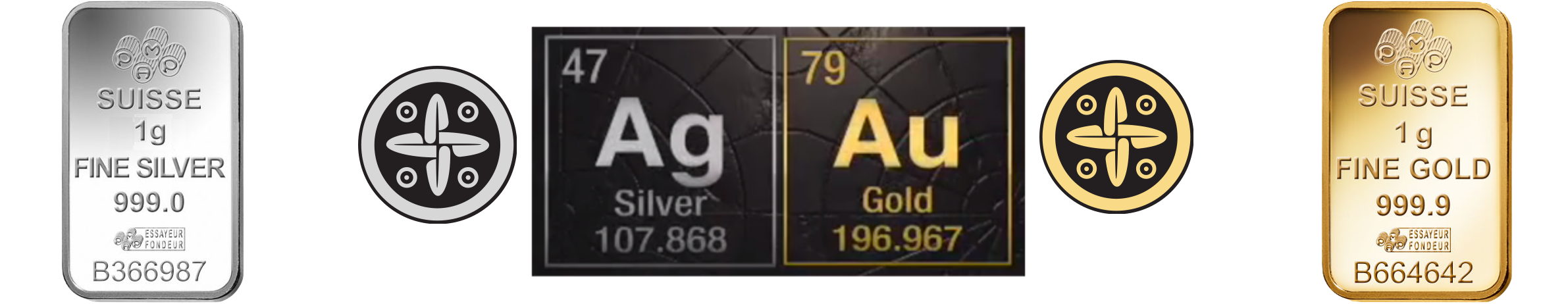

AgAu represents the direct ownership of silver and gold bullion allocated in Switzerland. We aim to be the easiest way to transact redeemable physical LBMA quality precious metals. FINMA (Swiss Financial Market Supervisory Authority) classified AgAu tokens as a payment token recognizing that it is an asset but not a security as of June, 2020.

Over millennials, gold has been proven to be the best store of value, medium over exchange and international unit of account. Since 1971, the fiat banking system had exacerbated the instability of the financial system. We believe that gold and silver are a superior form of money. For those who believe the same AgAu wants to provide with a true alternative to fiat currencies.

The principle of voluntaryism is core to the free trade of ideals, goods and services. AgAu offers a direct way to do so eliminating financial intermediaries. AgAu tokens allow for permission-less, decentralised, peer-to-peer transactions.

Over millennials, gold has been proven to be the best store of value, medium over exchange and international unit of account. Since 1971, the fiat banking system had exacerbated the instability of the financial system. We believe that gold and silver are a superior form of money. For those who believe the same AgAu wants to provide with a true alternative to fiat currencies.

AgAu believes in the fundamental human right of property. We believe that every human has an alienable right to own their thoughts, their own bodies and other private property. This is why we offer Direct Ownership. Each token represents the direct property of 1 gram of precious metal. 1 gram of gold for AGLD (₳u) and 1gram of Silver for ASLV (₳g). At any time, AgAu token holders can choose to redeem their tokens for the corresponding precious metal in Switzerland.

“In the spirit of the initial Blockchain community, we created AgAu the Peer-to-Peer, Electronic Money System backed by Silver (Ag) and Gold (Au) in Switzerland”

“In the spirit of the initial Blockchain community, we created AgAu the Peer-to-Peer, Electronic Money System backed by Silver (Ag) and Gold (Au) in Switzerland”

Create a tradeable digital token that can be used as a currency, a representation of an asset, a virtual share, a proof of membership or anything at all. These tokens use a standard coin API so your contract will be automatically compatible with any wallet, other contract or exchange also using this standard. The total amount of tokens in circulation can be set to a simple fixed amount or fluctuate based on any programmed ruleset.

By combining our proprietary smart contracts with blockchain technology and providing these tools to everyone.

Using a blockchain is cryptographically secure – the ledger is distributed across all nodes in the system making hacking near impossible. All of the solidity Ethereum smart contract code used for the token sale and vault account was fully audited by SmartDec, a firm specialized in Smart Contract Security Audit. No single authority has control, the network cannot be distorded or manipulated by a single controlling authority. No middleman.

Swiss Silver and Gold Electronic Money System secures investment from high profile bankers and commodity trading experts.

Precious metal Stablelecoin plugs into gold frenzy.

Referencing Satoshi Nakamoto’s white paper: Bitcoin, a peer-to-peer, electronic, cash system, AgAu makes a distinction between cash/currency and money.

Swiss Silver and Gold Electronic Money System has received an indicative response from FINMA classifying AgAu Tokens as Payment Tokens representing an asset — not a Security Token.

Blockchain startup attracts new investors.

Mark Valek joins AgAu.io Board of Advisors.

Mark Valek joins AgAu as an advisor.

"In the event of a monetary reset, the consensus across the world would most likely be set on gold." AgAu operates outside the legacy financial system and provides with a solution to depart from the fiat system and go back to sound money.

"The Financial Future We Want" connects cross-sector experts to redesign the financial industry and ensure digital inclusion for all.