Did you ever stop and ask yourself the simple question: What is money? Unfortunately, most people grow up adopting the perception that money is its own asset class, completely different from all other assets and goods. Because at some point someone said: This colored piece of paper is now money, and everybody just went with it. While this is actually pretty accurate for the Fiat currencies (USD, EUR, etc.) most people use nowadays, the properties of real money are inherently different. “Fiat” is Latin and means something like “let there be” (you might be familiar with the biblical quote “fiat lux” from Genesis 1:3, meaning “let there be light”). Accordingly, “fiat money” means “let there be money”. In the 2011 movie “Margin Call”, which portrays the 2008 crisis caused by Fiat money misallocation, the CEO of the depicted investment bank states:

“It’s just money, it’s made up. Pieces of paper with pictures on it so we don’t have to kill each other just to get something to eat. […] And it’s certainly no different today than it’s ever been. 1637, 1797, 1819, -37, -57, -84, 1901, -07, -29, 1937, 1974, 1987, […] -92, -97, 2000 and whatever we want to call this.”

– John Tuld (“Margin Call”, fictional character, 2011)

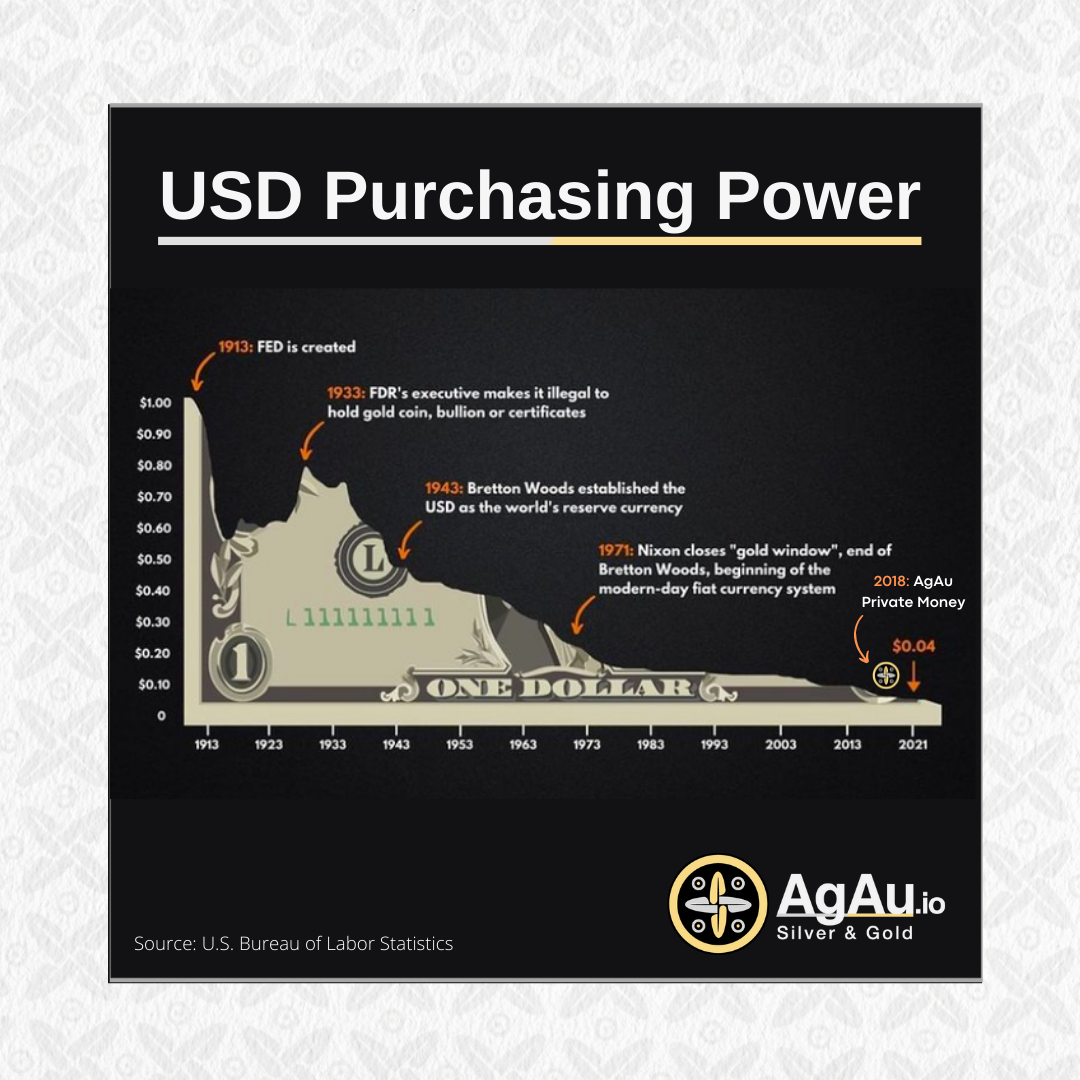

This quote also hints at the underlying properties of real money, in particular: merchantability. Real money emerged organically, thousands of years ago, as the most convenient indirect medium of exchange. For the longest time, people used precious metals like gold and silver as money because they have superior ‘money qualities’: their total quantity is limited, they are durable/non-perishable, divisible, fusible, storable, and portable. Because of gold’s intrinsic value, it is anti-fragile and therefore considered as the event hedge. That means: the more the economy is being challenged and disrupted, the stronger gold gets. The acceptance of Fiat money that is no longer backed by real assets, especially after the Nixon shock in 1971, has led to an inconceivable increase of the total money amount, in other words: inflation. Dynamics like the Cantillon effect are constantly shifting purchasing power away from the working class. Furthermore, the concomitant misallocations of the excessive money supply have caused countless financial crises, as recounted by John Tuld in the quote above.

So what if we went back to gold and even better: had a safe and private way to digitalize it to make it as convenient as possible? This is the mission of AgAu.io, the Peer-to-Peer Electronic Money System. AgAu uses the powerful combination of Swiss gold/silver and Blockchain technology to provide silver (“Ag”) and gold (“Au”) tokens that are 100% backed and redeemable. This way, AgAu tokens provide:

- Direct ownership of LBMA quality gold/silver (secured by Swiss private property laws)

- Therefore: intrinsic value and liquidity / solid price discovery (as opposed to BTC, etc.)

- The easiest way of silver/gold transactions & storage

- Peer-2-Peer → by using Distributed Ledger Technology and Smart Contracts, AgAu is safe, private, decentralized, and eliminates central points of failure. AgAu uses the Ethereum Blockchain which has the most developed ecosystem

________________________________________________________________________

We are inviting the community, investors, ecosystem, and media partners to reach out by following us on social media and expressing your interest.

Learn more about AgAu.io: The Peer-to-Peer, Electronic Money System

@AgAuCrypto

Facebook Instagram Twitter LinkedIn YouTube

________________________________________________________________________

References

AgAu AG, Zug, Switzerland, 2018.

Chandor, J. C. Margin Call. Lionsgate, 2011.