By now it has become evident to a majority of market participants, that a solution to the dilemma of the Fiat Money System and Fractional Reserve Banking is desperately required[1]. But which solution will prevail? In this article, we will take a closer look at Gold and Bitcoin, pointing out their differences. If you want to learn more about the properties of Gold, feel free to check out our “Why Gold?” series.

BTC

As the above-mentioned dilemma has become more and more evident, Bitcoin arose as a private sector initiative with the purpose of becoming a better alternative to Fiat. Most notably, the rise of Bitcoin inevitably forced significant amounts of people to be confronted with the question of what money actually is. As we explain in our article “The Solution to 50 Years of Inflation and Wealth Reallocation”, most people have grown up accepting Fiat money as a given standard money, an untouchable asset class on its own. Bitcoin has made the flaws of governmental Fiat Money obvious, because it incorporated a limited overall supply and utilizes a robust public encrypted ledger. While these are very important advantages, Bitcoin is technically still a Fiat currency, as it is not convertible into physical assets. Moreover, Bitcoin is not technologically resistant and faces serious problems of scalability and volatility.

One need only look to the price history of bitcoin in the last two years for evidence. At its highest point, around the beginning of 2018, bitcoin reached a price of about $20,000 per coin. About a year later, the price of one bitcoin hovered around $4,000. Besides overall volatility, Bitcoin has historically proven itself to be subject to market whims and news. Particularly as the cryptocurrency boom swept up a number of digital currencies into record-high prices around the end of 2017, news from the digital currency sphere could prompt investors to make quick decisions, sending the price of bitcoin upward or downward quickly:

This volatility is not inherent to gold, which incorporates thousands of years of trading history, whereas Bitcoin is a relatively young asset. In recent years, this has led to the emergence of stablecoins as a more appealing safe haven alternative for investors. So in order to return to more tangible and stable assets, let’s move on to Gold now.

Gold

In order to avoid replacing one Fiat with another, we have to take a look at established money systems before Fiat. One notices very quickly that Gold have prevailed as a superior form of money for the longest time in human history. This is hardly a surprise, considering its properties – Gold has always been universally appreciated for its shininess and material attributes, leading to excellent merchantability. That is why the BIS is classifying Gold as TIER 1 Capital. All the while, it also sustained an industrial demand (used as jewelry, etc.), giving it intrinsic value in combination with limited quantity. Gold’s acknowledged qualities have been proven over and over again by its antifragility:

The more our economy gets disrupted, the stronger gold gets. Therefore, it is more than ever considered as the number one event hedge.

In order to understand the critical qualities of money and why Bitcoin is at risk of being corrupted and failing to be a real money, we have to grasp the demand structure for different stages of money, as shown in the graph (Taghizadegan, p. 85).

In the case of a commodity money, the most merchantable good is used as a money. It usually also incorporates properties that simplify the trade (divisibility, storability, etc.). Gold is one example for commodity money, another one would be cigarettes in prison.

The next stage is the commodity money certificate – a certificate that acts as a deed of ownership for a commodity. An example would be banknotes in the primordial sense, that attested the existence of an according amount of gold stored in the bank’s secure vault. That way, you didn’t have to carry around your gold and the trade became even easier. This was the most efficient and useful system until it was subverted by governments, allowing only the usage of their central bank currency and eventually completely omitting the convertibility into gold. If governments had not subverted the financial intermediaries, our wealth would be a multiple of what it is today (check our other articles like this to learn more about this).

Now let’s take about proto sign money. This kind of money contains the possibility of becoming a sign money, while having a minimum of industrial demand. This is only possible due to an overwhelming monetary demand. However, the evolution into a sign money is unlikely, if there is no industrial demand at all (trust issue). An example of a proto sign money is Bitcoin. Its extremely slight industrial demand is mostly the ideological value it represents to its followers.

If the speculative demand for a proto sign money is superseded by the other forms of monetary demand, it evolves into a sign money. Otherwise it will turn into a speculative bubble and a pyramid scheme at the same time (because there was no foundation for assuming superior monetary qualities other than appreciation promises and ideological convictions).

A proto sign money can also evolve into a governmental sign money by force of a government, enforcing involuntary industrial demands (e.g. you have to pay your taxes in this currency). This of course is the most destructive form of money and all fiat currencies are examples.

Understanding these stages is of utmost importance, as it shows us how to arrive at the superior solution (also preventing Bitcoin from possibly becoming a governmental sign money):

We have to combine the most natural, efficient, useful and field-tested money – a commodity money certificate – with the special innovative monetary qualities of Bitcoin. This will create the most solid, sustainable and incorruptible money system imaginable.

Gold 2.0

In practice, the implementation would look like this: We start with a gold standard. Gold has been globally traded over millennials and is therefore the most probable consensus in case of any monetary reset. The tokens should attest direct ownership of gold stored in secure private vaults and every token should be redeemable for a set amount of gold. But, as cash becomes more and more irrelevant, instead of banknotes (i.e. ‘paper tokens’) we utilize encrypted digital tokens. This makes it all the more practical and allows secure anonymous P2P transfer to anywhere in the world. Hence, we eliminate central points of failure and financial intermediaries that could potentially be subverted by future governments.

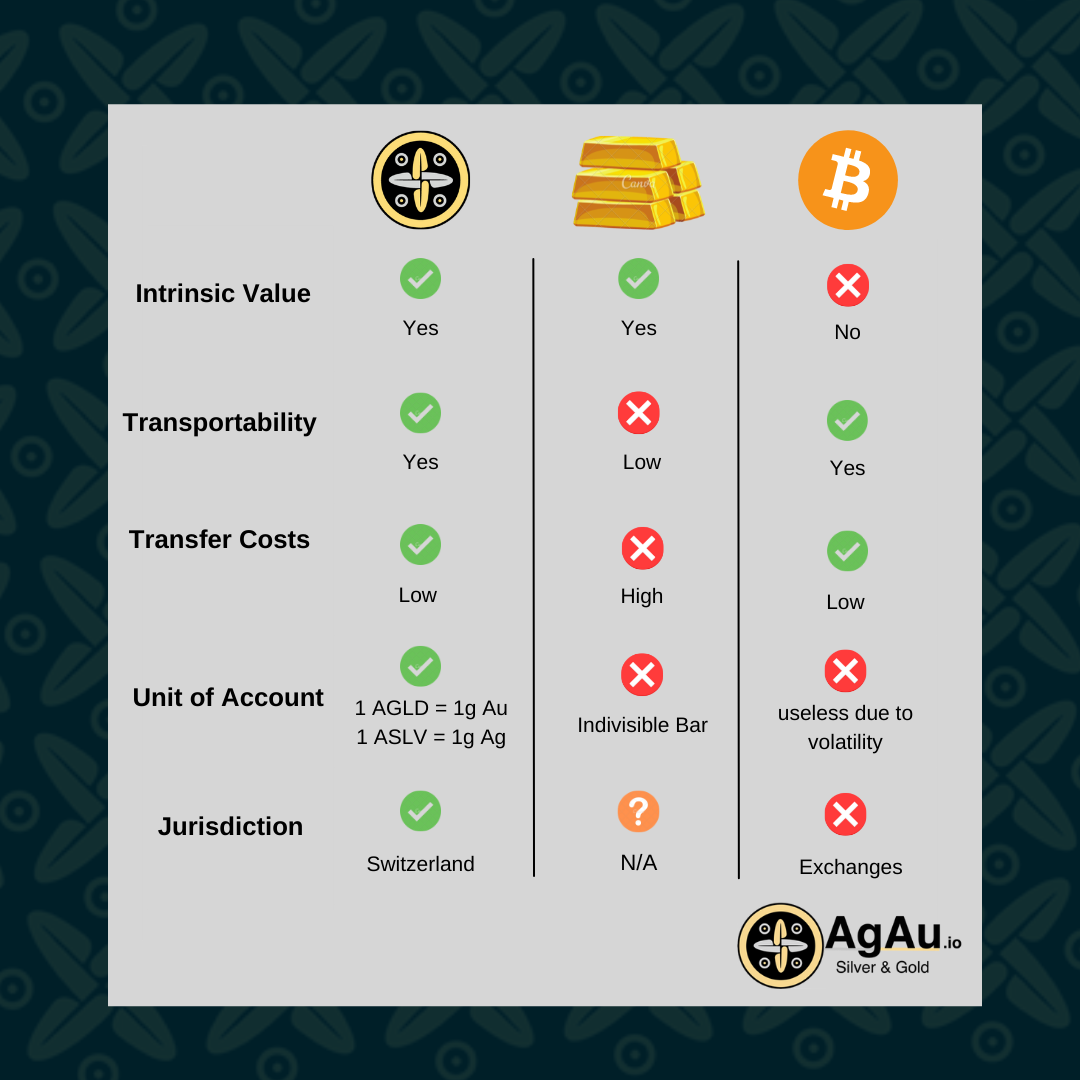

Such an electronic money system is the optimal solution and AgAu is already implementing it in real-life. AgAu uses the Blockchain with the most developed ecosystem – Ethereum – and smart contracts in order to be the easiest and safest way to store and transfer silver (“Ag”) and gold (“Au”). AgAu provides superior advantages:

- direct ownership of LBMA quality gold/silver (secured by Swiss private property laws)

- therefore: intrinsic value and liquidity / solid price discovery (as opposed to BTC, etc.)

- easiest way of silver/gold transactions & storage

- P2P → by using Distributed Ledger Technology and Smart Contracts, AgAu is safe, anonymous, private, decentralized and eliminates central points of failure

There is no doubt about it: An alternative monetary solution is needed and the urgency is increasing with every passing day. As a majority of people are realizing this fact, Bitcoin has provided us with valuable incentives, but is far from being the perfect solution. Due to the superior and proven money qualities of Gold, we believe that AgAu is that solution and invite the community, investors, ecosystem and media partners to reach out by following us on social media and expressing your interest. This way you can profit from having early access to this knowledge and spreading the required awareness.

Learn more about AgAu.io: The Peer-to-Peer, Electronic Money System

Follow us on social media: @AgAucrypto

Facebook Instagram Twitter LinkedIn YouTube

______________________________________________________________________________________________________

[1] Fractional Reserve Banking means, that banks are allowed to issue more credit money than they hold as reserves – therefore, credit money from one bank that eventually lands at another bank, can in turn serve this other bank as collateral to give out even more credit money and so on and so forth, resulting in an unconceivable multiplication of unsecured money supply. And the minimum reserve requirements have been continuously lowered, being practically non-existent nowadays.

______________________________________________________________________________________________________

References

CNBC. ‘Black Swan’ author calls bitcoin a ‘gimmick’ and a ‘game,’ says it resembles a Ponzi scheme. 23 Apr 2021. <https://www.cnbc.com/2021/04/23/bitcoin-a-gimmick-and-resembles-a-ponzi-scheme-black-swan-author-.html>.

CNBC. Bitcoin Price Above 4000 for the First Time in Two Weeks. 20 Dec 2018. <https://www.cnbc.com/2018/12/20/bitcoin-price-cryptocurrency-above-4000-for-first-time-in-two-weeks.html>.

Investopedia. Fractional Reserve Banking. 9 Mar 2021. <https://www.investopedia.com/terms/f/fractionalreservebanking.asp>.

News.bitcoin. Bitcoin Selloff fueled by New Investors. 20 Mar 2020. <https://news.bitcoin.com/bitcoin-sell-off-fueled-by-new-investors/>.

PwC. Basel IV. Sep 2016. <https://www.pwc.com/gx/en/advisory-services/basel-iv/basel-poster.pdf>.

Taghizadegan, Rahim. Österreichische Schule für Anleger. 2014.