The 8th SDG Goal aims to promote sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all. SDG8 also strives to drive progress, create decent jobs and improve living standards. In recent times, the COVID-19 health crisis has endangered the global economy and disrupted billions of lives. Once several businesses closed due to the crisis, job losses escalated and the International Labor Organization affirms that child labor rose to 160 million – the first increase in two decades.

Substandard working conditions lead to poverty, discrimination, and inequality affecting especially minority groups, such as women, youth, migrants, and people with disabilities. Vulnerable groups are in fact most affected by indecent working conditions and can be, in such cases, exposed to abuses. Nowadays, over 60% of all workers in developing countries lack any kind of employment contract. In 2019, more than 212 million people were unemployed. The COVID-19 crisis has only exacerbated these effects and has created an unprecedented human crisis that is hitting the poorest hardest. In March 2021, G20 and the GPFI group members discussed the devasting impact of the COVID-19 crisis on financial inclusion, and the urgency in promoting digital financial inclusion in order to increase the well-being of all and achieve sustainable and inclusive growth at a global level. “We need to focus on the best strategies to increase citizens’ and businesses’ awareness of digital financial opportunities and of the safeguards aimed at protecting them from the risks of the financial exclusion”.

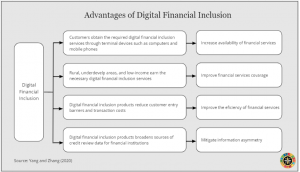

The digital finances are services delivered by mobile phones, computers, internet, cards linked to reliable digital payment system. We are talking about new financial products, businesses, software, and new forms of customer interaction, provided by the FinTech industry. These new technologies enable people, companies and governments to have access to payments, investment products, insurance, savings, credit facilities. The promotion of digital financial inclusion can provide steady financial support for the sustainable growth of small and micro enterprises, contributing directly with poverty reduction and improve the welfare.

In the figure below, you can see the advantages of the digital financial inclusion.

With AgAu, the emerging and developing economies will receive a quality education on emerging innovative solutions and access the alternative currency. The ‘Digital Financial Inclusion for All’ project by AgAu will help people to have access to the digital finances and international innovation, as well as develop entrepreneurial skills. In addition, we aim to distribute technology upgrades and innovation to enhance social equality.

Our goals include the creation of sustainable enterprises, in particular small and medium-sized that transition from the informal to the formal economy. This will further help build the economy and restore labor market institutions for stabilization and recovery. We aim to contribute to developing countries with intervention projects of digital financial inclusion. We aspire that with new businesses we will be able to create new job opportunities, further the economic growth, and foster economic activities. We actively advocate for the institution of socially inclusive practices, embrace diversity and hope to bring skilled and productive talents to a decent working standard and thus hope to nurture economic growth. To learn more about our ‘Digital Financial Inclusion for All’ project and our work related to the Sustainable Development Goals, click here.

______________________________________________________________________________________________________

Learn more about AgAu.io: The Peer-to-Peer, Electronic Money System

Follow us on social media: @AgAucrypto

Facebook Instagram Twitter LinkedIn YouTube

_____________________________________________________________________________________________________

References

Banca d’Italia. “G20: 1st Global Partnership for Financial Inclusion Meeting.” Bank of Italy, 25 March, 2021. https://www.bancaditalia.it/media/notizia/g20-1st-global-partnership-for-financial-inclusion-meeting/.

“Child Labour Rises to 160 Million – First Increase in Two Decades.” World Day Against Child Labour: Child Labour Rises to 160 Million – First Increase in Two Decades, 10 June 2021, https://www.ilo.org/global/about-the-ilo/newsroom/news/WCMS_800090/lang–en/index.htm.

Ozili, Peterson K. “Impact of Digital Finance on Financial Inclusion and Stability.” Borsa Istanbul Review, Elsevier, 17 Mar. 2018, https://www.sciencedirect.com/science/article/pii/S2214845017301503.

SDG Compass. “SDG 8: Promote Sustained, Inclusive and Sustainable Economic Growth, Full and Productive Employment and Decent Work for All.” SDG Compass, https://sdgcompass.org/sdgs/sdg-8/.

United Nations., “Goal 8 | Department of Economic and Social Affairs.” United Nations, United Nations, https://sdgs.un.org/goals/goal8.